Sustainable Investments Outperformed Traditional Funds in 2025

Sustainable investments saw strong growth in 2025, with a median return of 12.5%, significantly outperforming traditional funds, according to Morgan Stanley.

Despite the influx of capital, many market participants still lack knowledge of meaningful sustainability improvements backed by recognised environmental certification. This knowledge gap limits demand for products that deliver real sustainability value – investing in companies alone is not sufficient.

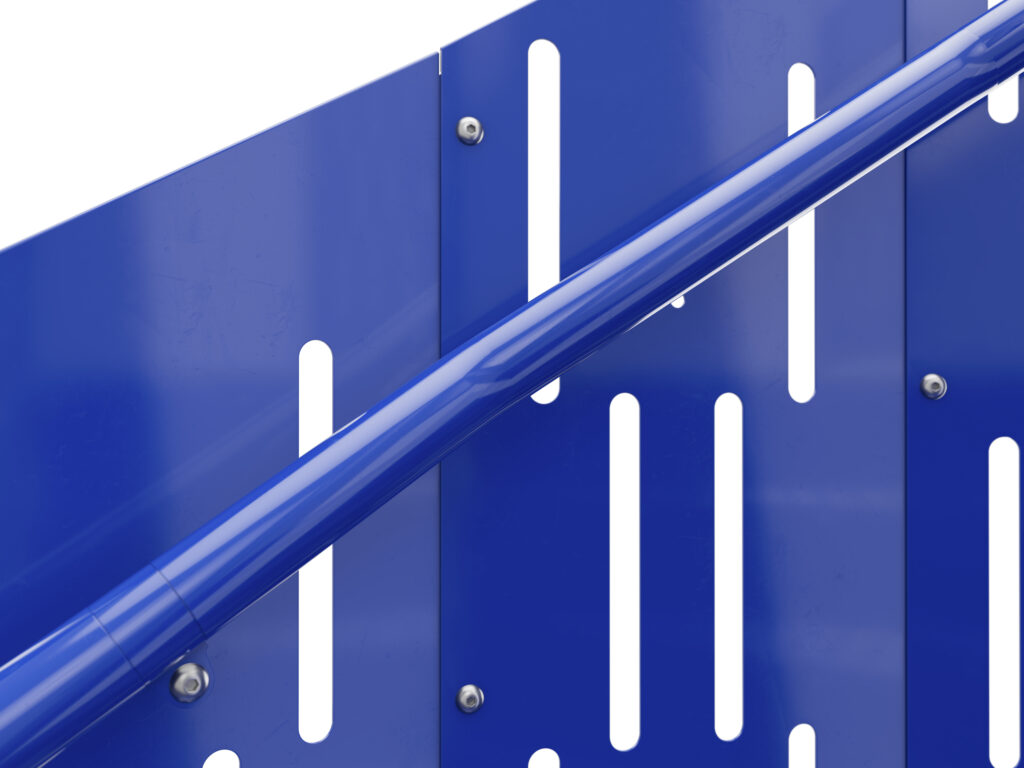

By Vikki Johansen Photo: Weland uses recognised environmental certification, reducing costs.

Published 19th January 2026.

Sustainable Funds Lead the Way

According to Morgan Stanley, sustainable funds outperformed traditional funds in the first half of 2025. The main driver was greater exposure to investments across Europe and globally. Assets under management (AUM) in sustainable funds reached a record USD 3.92 trillion as of 30 June, an increase of 11.5% since December 2024.

Net inflows to these funds totalled USD 16 billion, with second-quarter inflows more than compensating for modest early-year outflows. While this growth is lower than in previous years, the trend confirms that sustainability continues to attract capital.

Investors Prioritise Quality, Even in a Volatile Market

Despite geopolitical uncertainty and short-term market fluctuations, investors continue to favour sustainable solutions. Interest and capital follow quality, with many large funds showing strong activity and active participation (source: MSCI).

Knowledge Gaps Limit Demand for Verified Sustainability

Even as sustainable funds and investments continue to expand, a clear gap exists between interest and actual demand for substantive measures with recognised environmental and climate documentation.

One key reason is insufficient knowledge about how sustainability initiatives should be documented – particularly at the organisational level and in line with audited financial statements and reporting requirements.

Many market participants wish to make sustainable choices but are unsure which measures are truly material, how they should be evaluated across a product’s lifecycle, and what constitutes sufficient documentation and long-term action. As a result, high-quality solutions with solid certification do not always achieve the demand they deserve.

Sustainability Measures in Industry Are Long-Term

It is important to understand that sustainability measures in industry are rarely short-term or easily reversible, even during periods of political or economic turbulence. Adjustments in chemical usage or energy mix, for example, can lead to significant changes in production facilities and day-to-day operations. Such changes typically result from planned or implemented investments and shape the business over the long term.

Changes in chemical use may require new production processes, equipment, health and safety procedures, and regulatory approvals. Similarly, shifts in energy mix – such as electrification, biogas, or district heating – often involve investment in new infrastructure, long-term energy contracts, and technical commitments lasting many years.

Common to these initiatives is that they are capital- and knowledge-intensive. For this reason, they are rarely reversed quickly. When sustainability is integrated into a company’s business model and operations, it represents strategic, long-term choices rather than temporary adjustments.

Bridging the Knowledge Gap

Reducing the knowledge gap around lifecycle-wide measures, recognised certification, and their actual impact is crucial for increasing demand for genuinely sustainable solutions and ensuring effective capital allocation.

Selecting products with recognised environmental certification is a key lever to translate sustainable investments into practice.

Sustainable development depends as much on what products we choose to buy (or not buy) as on the investments we make.

How We Can Help

Through cross-disciplinary expertise, collaboration, structured sourcing, and targeted digital communication, we bridge the knowledge gap and increase demand for documented quality.

Contact us for the publication of professional content on construction, building materials, or scientific research supporting sustainable development.

post@greenbuilt.no / +47 47847774

Sources

European Sustainable-Fund Flows: Investors Stick, Not Twist | MSCI

Sustainable Investing Funds Beating Traditional Funds in 2025 | Morgan Stanley

Svanemerket study in Norwegian: Miljøkrav i kommuner – mangler kompetanse.

Read more Markedsledere prioriterte samarbeid med likesinnede i 2025

Read more: Byggevarer avgjørende for bærekraftig utvikling – vitenskap