Sustainable Investments Beat Traditional Option in 2025

Sustainable investments saw strong growth in 2025, significantly outperforming traditional funds, according to Morgan Stanley.

Despite the influx of capital, many market participants still lack knowledge of meaningful sustainability improvements backed by recognised environmental certification. This knowledge gap limits demand for products that deliver real sustainability value – investing in companies alone is not sufficient.

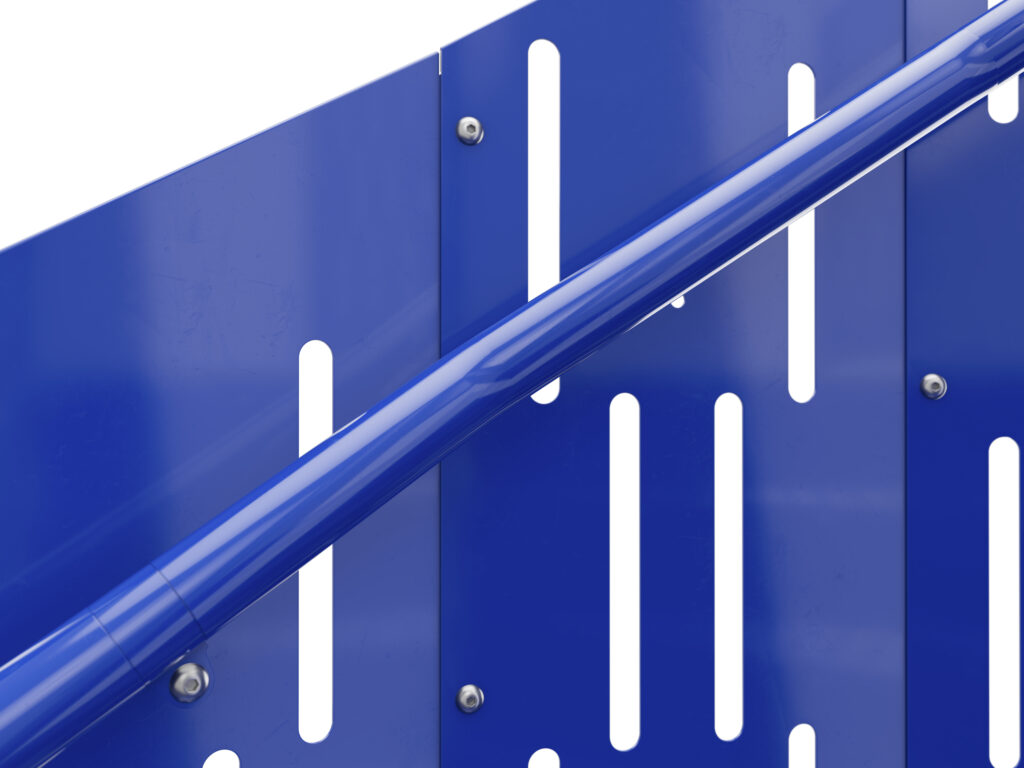

By Vikki Johansen Photo: Weland uses recognised environmental certification, reducing costs.

Published 19th January 2026. Updated 19th February with additional sources.

Sustainable funds lead the way

According to Morgan Stanley, sustainable funds outperformed traditional funds in 2025. The driving force was increased exposure to investments in Europe and globally. Assets under management (AUM) in sustainable funds reached a record $3.92 trillion as of June 30, up 11.5% from December 2024. Net inflows were $16 billion, with Q2 inflows offsetting small early-year outflows. Although below previous years, the trend confirms that sustainability continues to attract capital.

Despite geopolitical uncertainty and short-term market fluctuations, investors continue to bet on sustainable solutions. Interest and capital follow quality, and many large funds show strong activity and engagement (source: MSCI).

Knowledge gaps hinder demand for verified sustainability

Even as sustainable investments grow, a clear gap remains between interest and actual demand for meaningful initiatives with recognized environmental and climate documentation. A key reason is limited knowledge of how sustainability actions must be documented—particularly at the company level, in line with requirements for audited financial statements and reporting.

Many want to make sustainable choices but are unsure which measures are material, how to evaluate them across a complex lifecycle, and what constitutes meaningful documentation and long-term action. As a result, high-quality solutions with solid documentation do not always receive the demand for solid sustainable development.

Financial reporting requirements and corporate audits have steadily tightened, with independent international oversight. Sustainability reporting can improve in a similar way. The EU is progressing, China is improving through technology and regulatory frameworks, while the U.S. has lagged recently.

The EU has implemented comprehensive sustainability reporting rules to provide comparable, third-party-verified ESG information, although political resistance and simplification proposals affect scope. China has introduced basic ESG disclosure standards and is moving toward a national reporting system increasingly aligned with international frameworks, aiming for broad implementation by 2030, though human rights remain uncertain. Shanghai’s “Clean Air and Blue Sky” initiative provides an example.

In the U.S., sustainability reporting remains largely voluntary, with significant variation across states and weaker federal standards, so ESG-standardized reports do not yet carry the same regulatory weight as in the EU or China. U.S. authorities have withdrawn from several international climate and environmental agreements, including the Paris Agreement and UNFCCC, weakening key climate policies. This reduces national pressure for international cooperation but may encourage individuals, companies, and local governments to make independent, more ambitious climate choices.

“Where there is a will, there is a way” – Kristian Winther

Other influential and innovative figures, such as Sam Eyde, the industrialist behind multiple financially successful companies in early 1900s , often highlighted the slogan for ‘will’ as a guiding principle for innovation and execution. For him, ‘will’ was not merely intention, but the ability to turn plans and ideas into tangible industrial and societal impact.

Documented, better solutions already exist. Acting on the serious consequences science documents—where the wealthiest have an outsized impact on investing in better solutions—today requires only will and capability.

Global responsibility and emissions

Research shows the richest 10% globally—including middle classes in wealthy countries—account for an estimated 77% of overshoot emissions beyond planetary boundaries, particularly when ownership- and investment-related emissions are included. This contrasts sharply with the remaining 90% of the population and underscores the deep inequities of the climate crisis, with the potential to create billions of climate and environmental refugees.

Sustainability in industrial operations

Sustainable measures in industry are rarely short-term or easily reversible, even during political or economic instability. Adjustments in chemical use or energy mix can require major changes to factory processes, equipment, safety protocols, and regulatory approvals. Likewise, energy transitions—such as electrification, biogas, or district heating—often require long-term infrastructure investments and technical commitments.

These actions are capital- and knowledge-intensive and rarely reversed quickly. When sustainability is integrated into a business model and operations, it reflects long-term strategic choices rather than temporary adaptations.

Bridging the knowledge gap

Closing the knowledge gap on lifecycle impacts, recognized documentation, and actual results is essential to strengthen demand for genuinely sustainable solutions and ensure efficient capital allocation. Choosing products with verified environmental documentation from recognized third parties—such as independent authorities akin to financial regulators—is a key tool to translate sustainable investments into practice.

For sustainable development, the focus is as much on the products we buy or avoid as on the investments we make.

How we can help

Through cross-sector expertise, collaboration, structured categorization, and targeted digital communication, we bridge knowledge gaps and increase real demand for verified quality.

Contact us for publishing expert content on construction, building materials, or scientific insights for sustainable development.

post@greenbuilt.no / +47 47847774

Also read: Market leaders prioritized collaboration with like-minded partners in 2025 Strategy: B2B Lead Generation in a Challenging Economic Climate

Also read: Building materials are crucial for sustainable development – science. Building materials are the key to sustainable construction

Sources

Carbon Brief (World Bank 2018): Expect tens of millions of internal climate migrants by 2050, says World Bank

European Sustainable-Fund Flows: Investors Stick, Not Twist | MSCI: https://www.msci.com/research-and-insights/blog-post/european-sustainable-fund-flows-investors-stick-not-twist

Morgan Stanley. Sustainable Investing Funds Beating Traditional Funds in 2025 https://www.morganstanley.com/insights/articles/sustainable-funds-outperform-traditional-first-half-2025

Stockholm Resilience Centre (2025): Planetary boundaries – Stockholm Resilience Centre https://www.stockholmresilience.org/research/planetary-boundaries.html

Svanemerket (EU Ecolabel) survey: Environmental requirements in Norwegian municipalities – lacking competence

Zurich Inside Business (2024): There could be 1.2 billion climate refugees by 2050. Here’s what you need to know